Wake County Property Tax Rate 2024 Increase Chart

Wake County Property Tax Rate 2024 Increase Chart – While it’s very likely Wake County homeowners’ homes will increase tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate . Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 tax rate. As a rule of thumb, if a property’s value increased .

Wake County Property Tax Rate 2024 Increase Chart

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Raleigh Downtown | Raleigh NC

Source : www.facebook.com

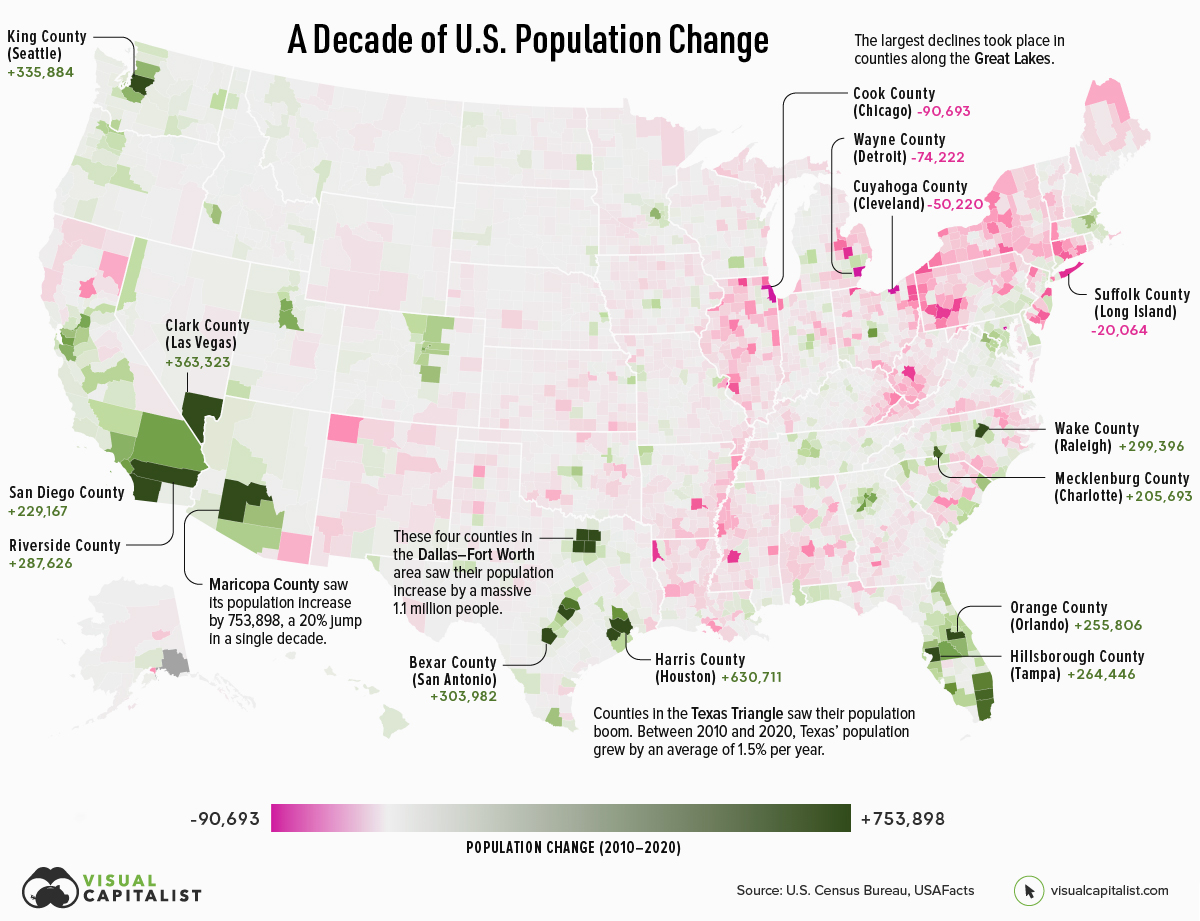

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

Wake County, NC Property Tax Calculator SmartAsset

Source : smartasset.com

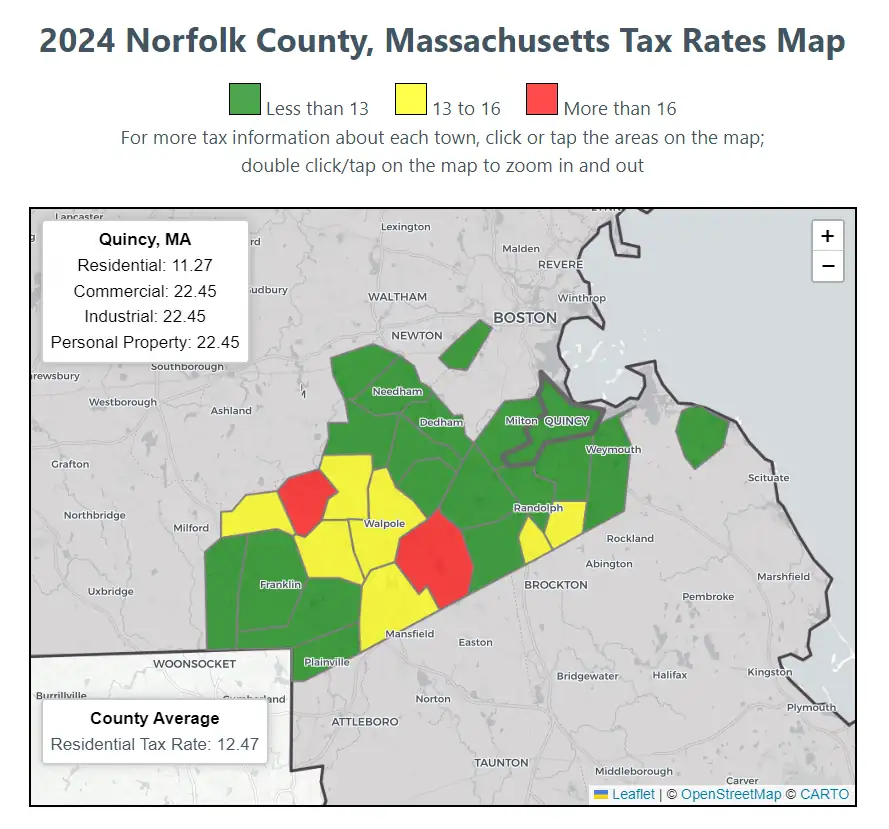

2024 Norfolk County Massachusetts Property Tax Rates | Residential

Source : joeshimkus.com

Wake County Property Tax Rate 2024 Increase Chart New property value notices to hit Wake County mailboxes starting : Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 tax bill would be if the county were to adopt the revenue-neutral tax . Wake County’s 2024 revaluation Based on a revenue-neutral tax rate, whether a homeowner pays more or less in taxes depends on the change in their individual property value compared to the .